Cash is a king

VENTURE CAPITAL, ACCELERATORS, AND B2G STARTUPS - The Infrastructure Gap in Financial Planning for Business-to-Government Companies

$183.5 billion. That's how much the US federal government awarded to small businesses in FY 2024 — an all-time record. The GovTech market is projected to hit $2.9 trillion by 2033. Funding is surging. Accelerators are multiplying. Government innovation offices are actively seeking startup partners. And yet, B2G startups keep dying. Not because their products fail. Not because the market isn't there. Because the financial tools they rely on — the same MRR-based templates, SaaS churn models, and linear growth projections that work beautifully for consumer software — are structurally incapable of modeling how government contracts actually work. Net-90 payment terms. Milestone-based invoicing. Multi-year commitments. S-curve adoption with 12–24 months of "Death Valley" before revenue accelerates. Working capital gaps that can exceed $500,000 before a single dollar arrives. Standard financial models hide all of this. The result: founders make spending decisions based on phantom revenue. Investors misprice risk using metrics designed for a different business model entirely. Accelerators evaluate companies with scorecards that don't match the operating reality those companies will face. We analyzed 50+ financial planning tools across four market segments. The finding: zero specifically address B2G revenue recognition, contract-based churn, or government payment cycle modeling. Not at the $150K enterprise tier. Not at the $300 template tier. Nowhere. We also examined regulatory requirements from the US GAO, UK Cabinet Office, and OECD — all of which mandate vendor financial viability assessment but offer no standardized framework for early-stage companies. The full report, "Venture Capital, Accelerators, and B2G Startups: The Infrastructure Gap in Financial Planning for Business-to-Government Companies," is a 20-page analytical deep-dive covering the VC blind spot, the accelerator paradox, the regulatory dimension, and what contract-aware financial infrastructure should actually look like.

February 17, 2026

An Analytical Review of Venture Capital Readiness, Accelerator Limitations, and the Systemic Tooling Deficit That Threatens the $2.9 Trillion GovTech Market

Executive Summary

Key Insights That Challenge the Status Quo

MRR is a fiction in GovTech. Government contracts operate on Net-60 to Net-180 payment terms, milestone invoicing, and multi-year commitments. Applying monthly subscription metrics to this reality does not simplify analysis—it falsifies it.

38% of your B2G portfolio is at structural risk. CB Insights reports that 38% of startups fail from cash mismanagement. In B2G, where payment delays of 90–180 days are standard, this is not a risk factor but a near-certainty for companies using conventional planning tools.

Regulatory forces will mandate this standard anyway. GAO (US), Cabinet Office (UK), and OECD guidelines already require financial viability assessment of government vendors. No standardized tool exists. The market will not wait indefinitely.

The alpha is in accuracy. VCs using SaaS metrics for B2G companies are systematically mispricing risk. They pass on structurally sound companies whose revenue looks “lumpy,” and overvalue companies approaching a cash wall. Contract-aware financial models give investors a proprietary lens to see real asset value that others miss.

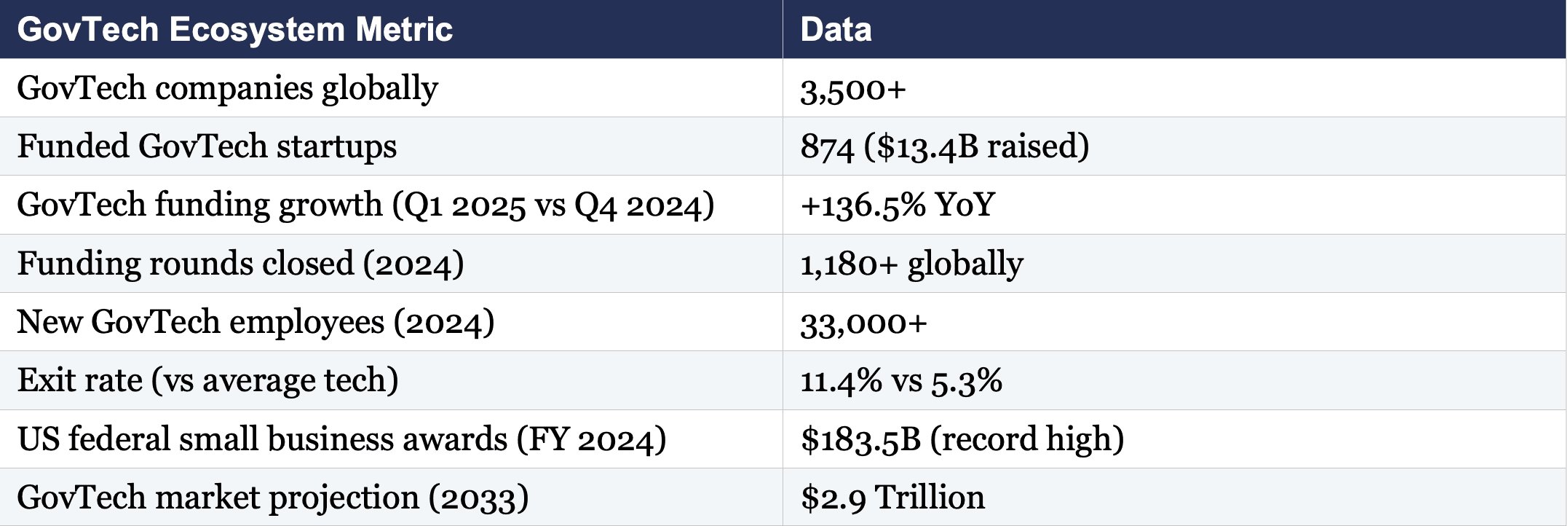

The world of government procurement is undergoing a historic transformation. In fiscal year 2024, the United States federal government awarded an all-time high of $183.5 billion to small businesses, representing nearly 29 percent of all government contracting dollars. Globally, the GovTech market is projected to reach $2.9 trillion by 2033, with GovTech startup funding surging by 136.5 percent year-over-year in Q1 2025 alone. Over 3,500 GovTech companies now operate worldwide, with 874 having raised a combined $13.4 billion in venture capital. The exit rate for GovTech companies stands at 11.4 percent, more than double the 5.3 percent average for technology companies overall.

These numbers tell a story of extraordinary opportunity. But they conceal a structural crisis that is destroying capital, undermining innovation, and eroding trust between governments and the startup ecosystem. The crisis is not about market demand. It is about financial infrastructure, or more precisely, the near-total absence of it.

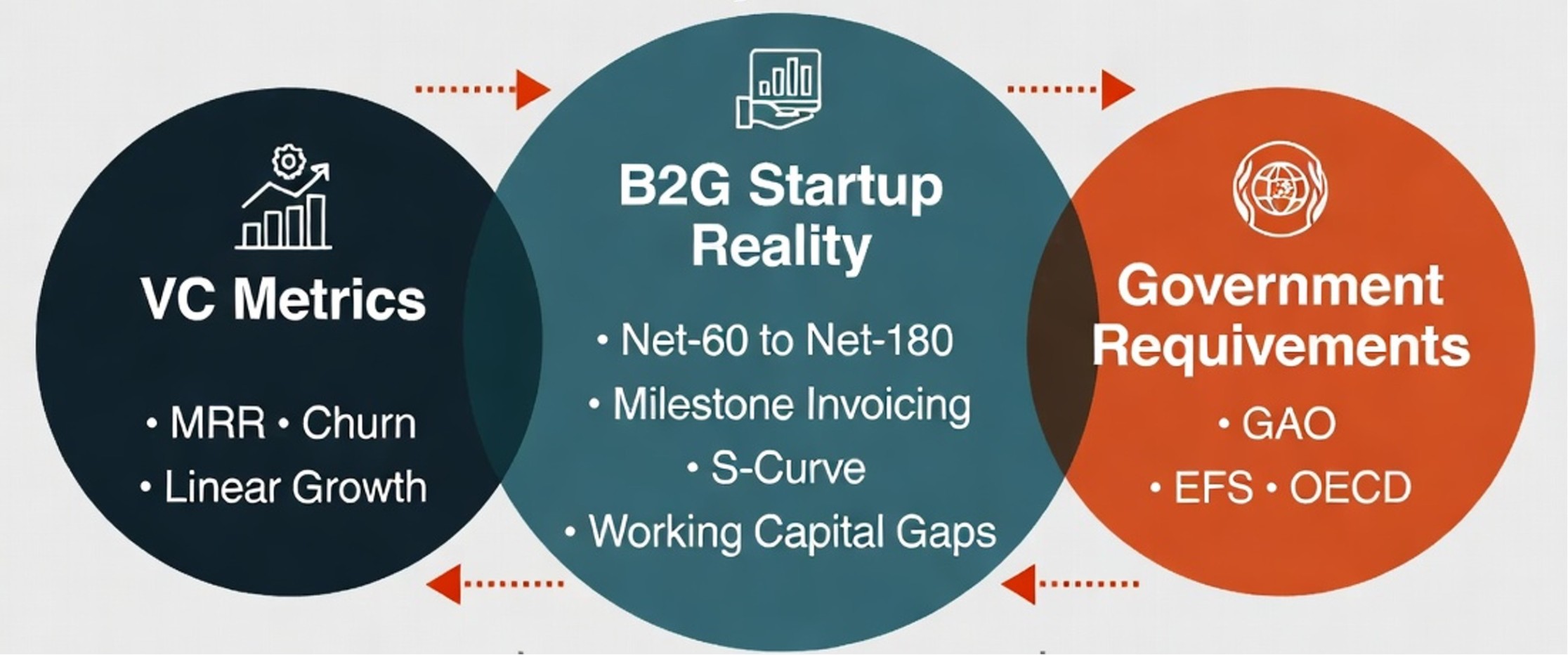

This report examines a fundamental disconnect at the heart of the Business-to-Government (B2G) ecosystem. On one side, venture capital funds and accelerators continue to evaluate B2G startups using metrics designed for consumer subscription businesses: Monthly Recurring Revenue (MRR), monthly churn rates, linear growth projections, and standard SaaS unit economics. On the other side, B2G startups operate in a reality defined by multi-year government contracts, Net-60 to Net-180 payment cycles, S-curve adoption patterns, milestone-based revenue recognition, and working capital gaps that can exceed $500,000 before a single dollar of revenue is collected.

The result is a systemic failure that manifests in three interconnected ways. Startups cannot plan accurately because available financial tools assume subscription-based revenue models. Investors cannot evaluate correctly because their standard metrics do not reflect contract-based business realities. And government agencies cannot assess vendor viability because startups present financial projections built on frameworks that bear no resemblance to how government contracts actually work.

According to CB Insights, 38 percent of startups fail because they run out of cash. In the B2G sector, where payment delays of 90 to 180 days are standard operating procedure, this statistic represents not a risk factor but a near-certainty for companies that rely on conventional financial planning tools.

A note on perspective: I write this not as an outside observer, but as someone who has operated on both sides of the B2G divide. As CIO of organizations with $10B+ in revenue and as co-leader of digital platforms serving over 3 million citizens, I have personally signed off on procurement protocols, navigated 18-month government sales cycles, and experienced Net-120 payment delays firsthand. I have seen why government payments are delayed—because I was the one managing the budgets and approval chains that cause those delays. This dual perspective, as both government executive and technology vendor, informs every argument in this analysis.

This report draws on regulatory documents from the U.S. Government Accountability Office (GAO), the UK Cabinet Office Sourcing Playbook, and OECD procurement guidelines; on practitioner discussions from Reddit, Hacker News, and professional forums; on market data from Tracxn, StartUs Insights, and Crunchbase; and on direct analysis of over 50 financial planning templates and tools currently available to founders. Its purpose is not to advocate for any single solution, but to rigorously document a market failure and to ask whether the institutions that support B2G startups, from venture funds to accelerators to government innovation programs, are prepared for the reality of what they are investing in.

Figure 1. The B2G Ecosystem Disconnect. Three stakeholder group operate with fundamentally misaligned financial frameworks

1. The World Has Changed: Governments Are Actively Seeking Startup Innovation

For decades, government procurement was the domain of established contractors. Large defense firms, legacy IT providers, and entrenched consulting companies dominated a system designed for predictability, not innovation. Startups were viewed as too risky, too small, and too unfamiliar with the byzantine rules of public procurement. That paradigm has decisively shifted.

1.1 The GovTech Explosion in Numbers

The data is unambiguous. According to Tracxn , the global GovTech sector now comprises over 3,500 companies, of which 874 have received venture funding totaling $13.4 billion. StartUs Insights reports that the sector grew 8.41 percent in the past year alone, with more than 1,180 funding rounds closed globally and a workforce exceeding 497,000 employees. The United States leads with $7.58 billion in total GovTech funding, and the sector has produced two unicorns with an exit rate of 11.4 percent, more than double the tech industry average of 5.3 percent.

But B2G is not limited to GovTech in the traditional sense. The U.S. federal government awarded $183.5 billion in contracts to small businesses in FY 2024. Beyond technology, federal contracting spans construction ($65 billion), professional services ($55 billion), IT and technology ($95 billion), healthcare ($45 billion), defense ($400 billion), and logistics ($40 billion). Every one of these sectors includes startups and small businesses that face the same fundamental challenge: how to survive financially while operating within government payment cycles that were designed for companies with deep balance sheets.

Table 1. GovTech Ecosystem Key Metrics. Sources: Tracxn GovTech Sector Report (2025); StartUs Insights GovTech Outlook 2025; SBA Small Business Federal Contracting Scorecard.

1.2 The Proliferation of Government Innovation Programs

Governments are not passively waiting for startups to find them. Across the OECD - OCDE , 42 percent of member governments now use dedicated GovTech initiatives to facilitate technology testing and adoption. Over 90,000 government entities globally engage in some form of GovTech procurement. The institutional architecture for government-startup collaboration is rapidly expanding.

In the United States, programs such as CivStart (a dedicated GovTech accelerator that has expanded from 12 to 15 startups per cohort), the Miami-Dade Innovation Authority (MDIA, which has evaluated 444 companies), and the nationwide network of 98 APEX/PTAC centers all represent institutional efforts to bridge the gap between government needs and startup capabilities. In the United Kingdom, GovStart has operated since 2017, while the GovTech Catalyst provides government-funded challenge competitions for AI and blockchain applications. The OECD maintains a global innovation case database of over 800 cases across 83 countries.

Organizations like Leading Cities, which runs the AcceliCITY accelerator program evaluating over 800 startups annually across international cohorts, represent a particularly important model. These programs sit at the precise intersection where startup innovation meets government demand, and they bear direct responsibility for the survival and success of their portfolio companies.

The question is whether these programs, and the venture capital ecosystem that feeds them, are equipped with the financial tools and frameworks necessary to fulfill that responsibility.

1.3 The Question That No One Is Asking

The growth statistics are impressive. The institutional momentum is real. But beneath the headline numbers lies an uncomfortable question: if government procurement is growing, if funding is flowing, and if institutional support is expanding, why do B2G startups continue to fail at such alarming rates?

The answer, as this report will demonstrate, is not about market demand or product quality. It is about financial planning infrastructure. Specifically, it is about the fact that every major participant in the B2G ecosystem, from venture capitalists to accelerator managers to government procurement officers, continues to use financial tools and metrics that were designed for a fundamentally different type of business.

2. The Venture Capital Blind Spot: When Standard Metrics Become Dangerous

Venture capital has developed a remarkably sophisticated toolkit for evaluating software companies. Monthly Recurring Revenue, Annual Recurring Revenue, Net Revenue Retention, Customer Acquisition Cost, Lifetime Value, the Rule of 40, the Magic Number: these metrics form a shared language that enables investors to rapidly assess, compare, and value subscription businesses. This language works brilliantly for consumer SaaS, for enterprise software sold on monthly or annual subscriptions, and for product-led growth companies with predictable expansion patterns.

It does not work for B2G.

2.1 The Monthly Subscription Fallacy

The foundational assumption of SaaS metrics is that revenue arrives in regular, predictable monthly installments. A customer subscribes, pays monthly, and may cancel at any time. MRR captures this reality perfectly. But government contracts do not operate on monthly subscriptions. A B2G company might sign a $500,000 contract with Net-90 payment terms, milestone-based deliverables over 24 months, and a renewal decision that occurs once, at the end of the contract period, not every month.

Practitioners on Hacker News have articulated this disconnect with precision. In discussions about SaaS metrics, participants have noted that annual or multi-year contracts require fundamentally different revenue recognition approaches than monthly subscriptions. When a B2G company reports MRR by simply dividing its contract value by twelve, it creates an illusion of steady monthly cash flow that bears no relationship to when money actually arrives in the bank account.

"Net 90 is standard for enterprise... You're not getting squeezed, that's just how big companies operate."- Reddit user, r/smallbusiness, on payment terms

On Reddit, founders in communities like r/SaaS have raised this issue directly. One founder asked whether companies whose clients pay upfront for 12, 24, or 36-month subscriptions should still discuss their metrics in MRR terms. The responses revealed widespread confusion, with one participant noting that standard metrics did not seem to capture the reality of their business model. This confusion is not a minor reporting technicality. It determines how companies are valued, how much capital they raise, and whether investors understand the actual cash dynamics of their business.

2.2 The Churn Measurement Problem

In traditional SaaS, churn is measured monthly. A 5 percent monthly churn rate is concerning; a 2 percent rate is healthy. Venture capitalists use these figures to calculate Lifetime Value, to assess product-market fit, and to project long-term revenue trajectories. For B2G companies, monthly churn is a meaningless concept.

Government clients do not make monthly subscription decisions. They sign multi-year contracts and make renewal decisions at discrete intervals, typically every one to five years. A B2G company might have zero churn for 36 months and then lose 30 percent of its revenue in a single quarter when multiple contracts come up for renewal simultaneously. Modeling this as a smooth monthly churn curve not only produces inaccurate projections, it fundamentally misrepresents the risk profile of the business.

The standard SaaS churn benchmarks, where annual customer churn rates of around 5 percent are considered healthy and best-in-class Net Revenue Retention hovers between 110 and 120 percent, simply do not translate to a world where churn is discrete and concentrated at renewal points. Applying these benchmarks to B2G companies leads investors to either overvalue companies (by assuming artificially low ongoing churn) or to reject them entirely (by misinterpreting lumpy renewal-based revenue as instability).

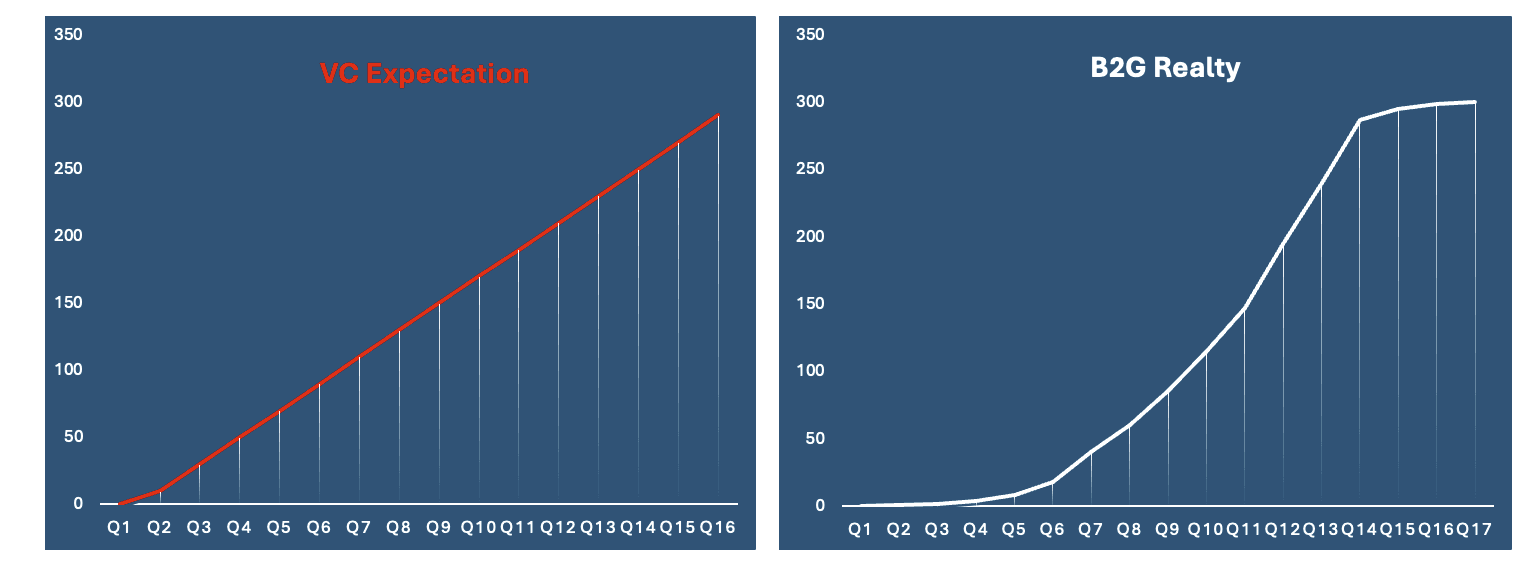

2.3 The Linear Growth Fantasy

Perhaps the most dangerous metric mismatch concerns growth expectations. Venture capital orthodoxy prizes predictable, compounding growth. The T2D3 framework (Triple, Triple, Double, Double, Double) envisions a growth trajectory from $2 million to $100 million ARR over five years. This model assumes that customer acquisition scales linearly with sales investment, and that revenue compounds smoothly over time.

B2G growth does not work this way. The diffusion of innovations research pioneered by Everett Rogers demonstrates that technology adoption in conservative institutional environments follows an S-curve pattern: a long, slow ramp-up period during which the startup navigates procurement bureaucracies, obtains necessary certifications (FedRAMP, SOC2, StateRAMP), conducts pilots, and builds the social proof needed to accelerate adoption. This is followed by a rapid scaling phase as neighboring agencies observe successful implementations and replicate them, and finally a saturation phase as the addressable market matures.

For a GovTech startup, the ramp-up phase can last 12 to 24 months. During this period, expenses are at their maximum (certifications, pilot deployments, compliance work) while revenue is at its minimum. A linear growth model will show revenue during this period that simply does not exist, leading founders to make hiring and spending decisions based on phantom income.

Figure 2: The Growth Model Mismatch. VC expectations assume hockey-stick or linear quick growth; B2G reality follows an S-curve with a prolonged ramp-up period that standard models do not account for.

2.4 Lessons from the Field: The MISTO Experience

The gap between VC expectations and B2G reality is not theoretical. The experience of MISTO, a City-as-a-Service platform recognized by Bloomberg Philanthropies and Leading Cities as a top-50 smart city innovation, illustrates the challenge precisely. Despite international recognition and demonstrated impact serving millions of users, engagement with the investment community repeatedly encountered the same structural mismatch: investors evaluating the company through the lens of standard SaaS metrics that could not accommodate government procurement cycles, milestone-based revenue, or the long sales timelines inherent in municipal technology adoption.

This experience, replicated across hundreds of B2G startups globally, points to a systemic problem rather than an individual company challenge. When every investor in a market uses the same evaluation framework, and that framework is structurally incompatible with the market being evaluated, the result is not just capital misallocation, but a chilling effect that discourages founders from pursuing government opportunities altogether.

2.5 The Opportunity Cost for Venture Capital

The preceding analysis might read as a problem for founders. It is not. It is a problem for investors, and its cost is measured in destroyed returns. When a venture fund deploys $500,000 into a B2G startup that burns through its runway due to a foreseeable cash gap that a proper financial model would have revealed six months in advance, that capital is not merely lost to a “failed startup.” It is lost to a failure of financial infrastructure, which is a fundamentally different and more preventable category of loss.

Consider the capital efficiency implications. A B2G startup operating without a contract-aware financial model will typically require 25 to 40 percent more working capital than a comparable company that has accurately projected its cash gaps and arranged bridge financing in advance. This excess capital burn is not driven by product development or customer acquisition. It is driven by emergency financing, late-stage negotiations with lenders at unfavorable terms, and the opportunity cost of founder time diverted from building the business to managing preventable cash crises.

For the investor, the consequence is twofold. First, portfolio companies burn capital faster than projected, requiring unplanned bridge rounds that dilute earlier investors or, worse, lead to down rounds that destroy value. Second, and more insidiously, investors applying SaaS-calibrated evaluation frameworks to B2G deal flow systematically misprice the opportunities in front of them. They pass on structurally sound companies whose revenue looks “lumpy” by SaaS standards, and they overvalue companies whose sanitized MRR projections conceal an approaching cash wall. In both cases, the investor’s alpha is eroded not by market conditions or product risk, but by the inadequacy of the analytical lens.

The implication for GovTech-focused funds and accelerators is particularly acute. If 38 percent of startups fail due to cash mismanagement, and if the B2G operating environment amplifies cash risk by a factor of three or more, then a significant portion of any B2G-focused portfolio is exposed to a risk category that the fund’s current evaluation tools are not designed to detect. This is not a thesis problem or a market problem. It is a due diligence infrastructure problem, and it has a concrete cost measured in write-downs and missed returns.

3. The Startup Survival Paradox: Caught Between Two Worlds

B2G startups find themselves trapped in an impossible position. They must speak the language of venture capital to raise funding, presenting MRR projections, monthly churn rates, and linear growth curves that satisfy investor expectations. Simultaneously, they must survive in an operating environment where none of these metrics reflect reality. The tension between these two demands is not a minor inconvenience. It is an existential threat.

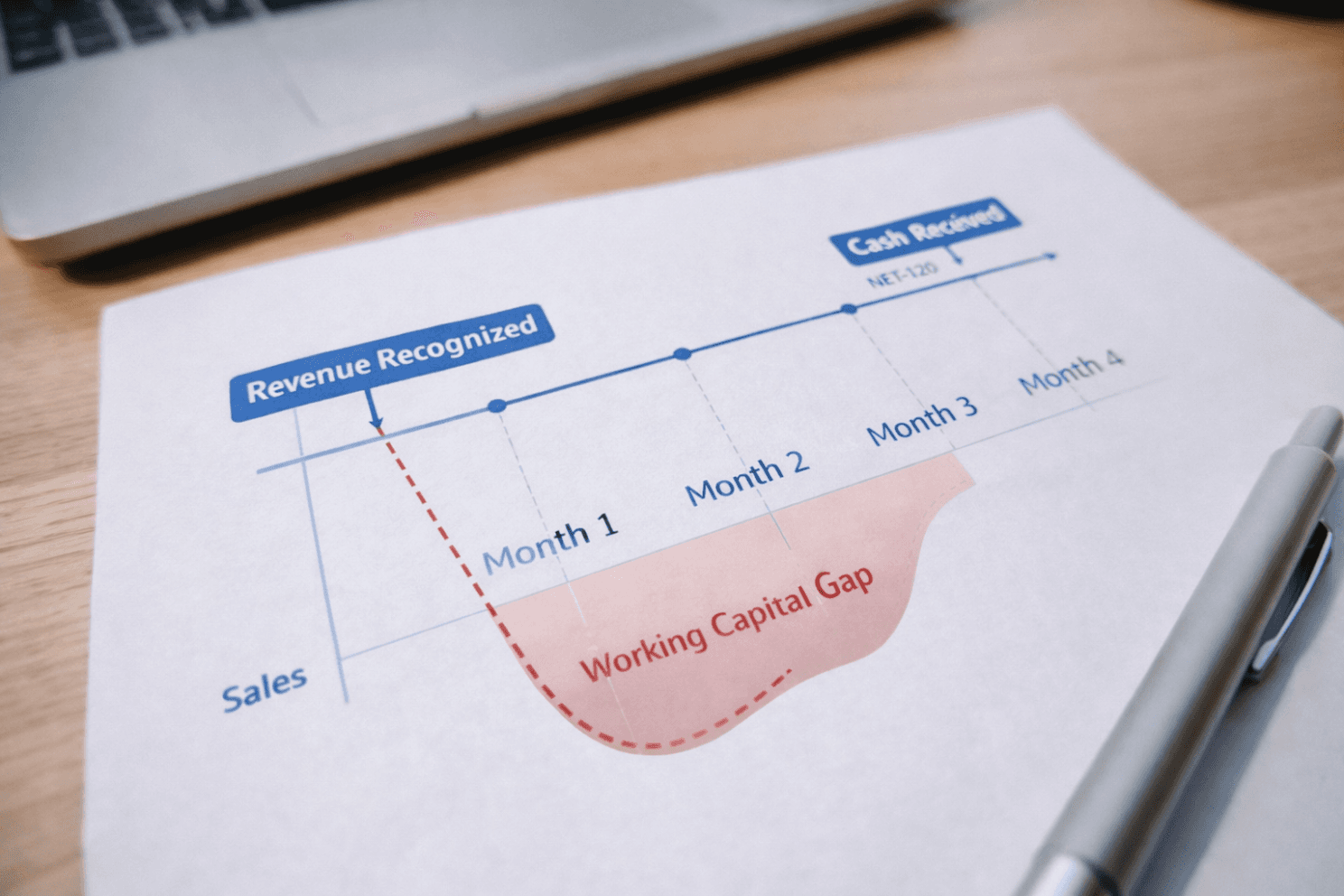

3.1 The Cash Flow Time Bomb

Consider a concrete scenario. A GovTech startup wins its first significant government contract: $500,000 over 18 months, with Net-90 payment terms and milestone-based invoicing. In the investor presentation, this appears as approximately $28,000 in monthly recurring revenue, a figure that suggests a healthy, growing business. In reality, the startup will need to fund three to six months of operations, including salaries, cloud infrastructure, compliance costs, and contractor payments, before receiving any revenue whatsoever.

Research indicates that over 70 percent of government contractors experience significant payment delays. Discussions on professional forums confirm that Net-90 frequently becomes Net-120 or even Net-165 in practice, as bureaucratic approval processes extend beyond contractual terms. One Reddit contributor described a situation where a defense contractor's approved payments were delayed for months beyond the already-extended payment terms due to internal processing requirements.

"My primary client is switching to Net 90 payment... It's a lot of money and I need to pay the damn rent." - Reddit user, r/smallbusiness, on the reality of extended payment terms

The CB Insights finding that 38 percent of startups fail because they run out of cash takes on a particularly ominous meaning in this context. For a B2G startup, running out of cash is not primarily a consequence of poor product-market fit or excessive spending. It is a structural feature of the operating environment, one that conventional financial planning tools are not designed to anticipate or model.

3.2 The Overtrading Trap

There is a particularly insidious variant of this problem known as overtrading, in which a company fails precisely at the moment of its greatest apparent success. A B2G startup that wins multiple government contracts simultaneously may appear to investors as a company executing brilliantly. In reality, each new contract creates an additional working capital gap: more staff to hire, more infrastructure to deploy, more compliance work to complete, all financed by the startup's existing cash reserves while revenue remains months away.

Without a financial model that explicitly tracks the relationship between contract signing, service delivery, invoicing, and cash receipt, founders cannot see this trap approaching. By the time the cash crisis materializes, it is often too late. The company has committed resources it cannot fund, and the very contracts that were supposed to drive growth become the instruments of failure.

Brex, the financial services firm, has documented this pattern extensively, noting that startups with large project-based contracts face particular vulnerability, as resources are invested upfront but payment may not arrive for 60, 90, or even 120 days. The impact cascades through every aspect of the business, from payroll to vendor relationships to growth opportunities.

3.3 Two Paths, One Contract: A Modeled Comparison

To illustrate the practical difference that financial infrastructure makes, consider two hypothetical GovTech startups, both pre-seed, both winning their first municipal contract worth $420,000 over 24 months with Net-90 payment terms and quarterly milestone invoicing.

Company A (Standard SaaS Model): The founders build their financial projection using a standard SaaS template. The model shows $17,500 in monthly revenue starting from contract signature. Believing cash will arrive within 30 days (the template’s default assumption), they hire two engineers and a project manager immediately. By month four, they have spent $180,000 on salaries and infrastructure. Their first milestone invoice, submitted in month three, triggers a Net-90 payment cycle. The actual cash arrives in month seven—if the government processes on time. By month five, the startup is insolvent. The contract is reassigned. The investors write off their seed round entirely.

Company B (Contract-Aware Model): The founders model their contract with realistic assumptions: quarterly milestone invoicing, Net-90 payment terms, and an S-curve ramp-up. The model reveals a $165,000 working capital gap between months three and eight. Armed with this projection, they take three decisive actions before signing the contract: they negotiate a $50,000 advance payment clause, they secure a $75,000 government contract factoring line at 3.5 percent, and they phase their hiring to align with cash receipt rather than contract start. The startup survives the gap, delivers successfully, and wins a follow-on contract. The investors see a 4x return within 36 months.

The difference between these two outcomes is not talent, product quality, or market timing. It is financial visibility. Company A used a model that hid the cash gap. Company B used a model that revealed it. The cost of the wrong model, in this case, was total loss of investor capital plus a failed government innovation initiative. The cost of the right model was $2,625 in factoring fees.

3.4 The Financial Literacy Gap

Compounding the structural challenge is a widespread gap in B2G-specific financial literacy. Most founder education resources, from Y Combinator's Startup School to accelerator curricula worldwide, teach SaaS financial modeling. The templates available for free download (Christoph Janz's SaaS template, Ben Murray's SaaS CFO toolkit) are excellent for subscription businesses but structurally incapable of modeling government contract economics.

A founder coming out of a typical accelerator program will know how to calculate MRR, LTV/CAC ratios, and payback periods. They will not know how to model the working capital impact of Net-90 payment terms across a portfolio of overlapping government contracts, or how to project cash flow when revenue recognition follows milestone completion rather than monthly accrual, or how to present S-curve adoption patterns to investors who expect hockey-stick growth.

This gap is not the founder's fault. It is the ecosystem's failure to provide appropriate tools. And it creates a dangerous dynamic where founders either (a) present misleading financial projections that they genuinely believe to be accurate, or (b) understand the inaccuracy of their models but present them anyway because there is nothing better available.

4. The Accelerator Paradox: Well-Intentioned, Poorly Equipped

Accelerators and government innovation programs represent the most promising bridge between the startup world and government procurement. They have the relationships, the domain expertise, and the institutional incentive to help B2G startups succeed. Yet they face the same fundamental tooling problem that afflicts the broader ecosystem.

4.1 Evaluating Startups with the Wrong Scorecard

When an accelerator like CivStart, Leading Cities (AcceliCITY), or MDIA evaluates startups for their cohorts, they must assess financial viability. But what documents do startups provide? The same pitch decks and financial projections that they prepare for VC investors: MRR-based revenue projections, monthly churn assumptions, linear growth curves. The accelerator receives information formatted for a B2C SaaS evaluation framework and must use it to make decisions about companies entering a B2G operating environment.

This creates a double bind. If the accelerator accepts the VC-formatted financials at face value, it fails to identify the cash flow risks that will threaten the startup's survival during the program. If it rejects the standard format and demands B2G-specific financial modeling, it finds that neither the startup nor the accelerator itself has the tools to produce such analysis.

The result is that accelerator selection and support decisions are made based on information that everyone involved knows, at some level, to be inadequate. The startup's financial model says it will break even in month 14, but no one has accounted for the fact that government payment cycles mean cash arrives in month 17 at the earliest. The disconnect is not hidden; it is simply normalized because no alternative framework exists.

4.2 The Government Agency Perspective

Government innovation offices face their own version of this problem, with regulatory teeth behind it. In the United States, the Government Accountability Office (GAO) mandates that agencies assess the financial capability of contractors before awarding contracts. The contractor must demonstrate sufficient financial resources to perform the contract before receiving payment. For a pre-revenue startup, meeting this requirement without a detailed, B2G-specific cash flow model is effectively impossible.

In the United Kingdom, the Cabinet Office Sourcing Playbook requires mandatory Economic and Financial Standing (EFS) assessments for all public contract suppliers. A specific Financial Viability Risk Assessment Tool exists for this purpose. The OECD has recommended standardized IT-based tools for vendor risk assessment across its member nations.

These regulatory requirements create direct institutional demand for the kind of financial modeling that does not yet exist in standardized form. Each government agency is left to develop its own assessment criteria, creating inconsistency, inefficiency, and an additional barrier to entry for startups that must navigate different evaluation frameworks for every jurisdiction they serve.

4.3 Questions for the Ecosystem

Given this analysis, several questions emerge that accelerators, innovation funds, and ecosystem builders should consider seriously:

When accelerators like CivStart, Leading Cities, or Cemex Ventures evaluate B2G startups for their cohorts, are their financial evaluation criteria calibrated for contract-based revenue models, or do they default to SaaS metrics?

When MDIA evaluates 444 companies for government innovation matching, what financial framework are those companies presenting, and does it accurately reflect the cash flow dynamics they will face?

When the 98 APEX/PTAC centers nationwide train small businesses for government contracting, do their curricula include financial planning tools designed for government payment cycles?

When GovTech-focused funds like Govtech Fund (the first VC fund dedicated to government technology) or investors like Andreessen Horowitz and 8VC evaluate GovTech deals, do their due diligence frameworks account for the fact that standard SaaS metrics systematically misrepresent B2G business performance?

These are not rhetorical questions. They point to a concrete gap in the infrastructure that supports B2G innovation, a gap that has real consequences measured in failed startups, misallocated capital, and government innovation programs that underperform their potential.

5. The Financial Planning Tool Landscape: An Analytical Review

To understand the scope of the tooling deficit, it is necessary to examine what is actually available to B2G founders today. This section provides a comprehensive analysis of the financial planning landscape across four market segments, evaluating each for its suitability to B2G business modeling.

5.1 Segment 1: Enterprise FP&A Platforms ($50K to $150K+ per year)

The enterprise tier includes platforms such as Anaplan, Workday Adaptive Planning, Onestream, and Planful. These are powerful tools designed for organizations with $100 million or more in annual revenue and dedicated FP&A teams. They excel at financial consolidation, variance analysis, and sophisticated scenario modeling. Their accounts receivable and accounts payable capabilities pull actual data from ERP systems like NetSuite, SAP, and Oracle, providing detailed aging reports and historical trend analysis.

Limitation for B2G startups: These platforms are designed for tracking and analyzing existing operations, not for projecting pre-revenue scenarios. They require historical data to function. A pre-seed or seed-stage B2G startup has no historical AR data to import, no ERP system to integrate with, and no budget for a $50,000+ annual subscription. More fundamentally, these tools treat payment delays as something to be measured after the fact, not as a forward-looking planning input.

5.2 Segment 2: Mid-Market FP&A ($24K to $72K per year)

Mid-market tools such as Vena Solutions, Cube, and Datarails target companies in the $20 million to $100 million revenue range. They typically provide Excel-native interfaces with automation, governance, and collaboration layers. These platforms connect to accounting systems for real-time AR and AP data and can automate consolidation and reporting.

Limitation for B2G startups: Like their enterprise counterparts, these tools are fundamentally dependent on historical accounting data. They automate and enhance existing financial operations but do not help a founder model future scenarios based on contract assumptions. For a startup that has not yet received its first government payment, these tools offer no functionality. The price point, while lower than enterprise solutions, remains prohibitive for early-stage companies.

5.3 Segment 3: SMB and Growth-Stage Tools ($12K to $36K per year)

This segment includes platforms like Jirav, Mosaic, Runway, and Finmark (now part of the Bill.com ecosystem). These tools are specifically designed for growing startups and small businesses. They offer driver-based modeling, SaaS metric dashboards, and integration with accounting platforms like QuickBooks and Xero.

Critical limitation for B2G startups: Every tool in this segment is built around traditional SaaS metrics. They model MRR growth, monthly churn, linear customer acquisition, and standard SaaS unit economics. None of them handle contract-based revenue with variable payment terms. None model multi-year deals with milestone-based invoicing. None incorporate S-curve adoption patterns. None calculate working capital gaps based on Net-60 to Net-180 government payment cycles. For a B2G founder, using Jirav or Mosaic is like navigating Arctic waters with a map of the Caribbean: the tool works perfectly, just not for the territory you are actually in.

5.4 Segment 4: Excel Template Marketplaces ($10 to $300 one-time)

The most accessible tier consists of downloadable spreadsheet templates from marketplaces such as eFinancialModels (which hosts over 2,000 templates), Eloquens, and FinModelsLab, as well as free templates from SaaS thought leaders like Christoph Janz and Ben Murray.

Critical limitation for B2G startups: A systematic review of over 50 templates across these platforms reveals a striking gap: zero templates specifically address B2G revenue recognition, contract-based churn at renewal points, S-curve adoption modeling, or government payment cycle projections. Every template reviewed assumes some variant of monthly subscription revenue with linear or exponential growth. While some enterprise templates include basic accounts receivable assumptions, none treat payment delay modeling as a core planning input rather than a secondary consideration.

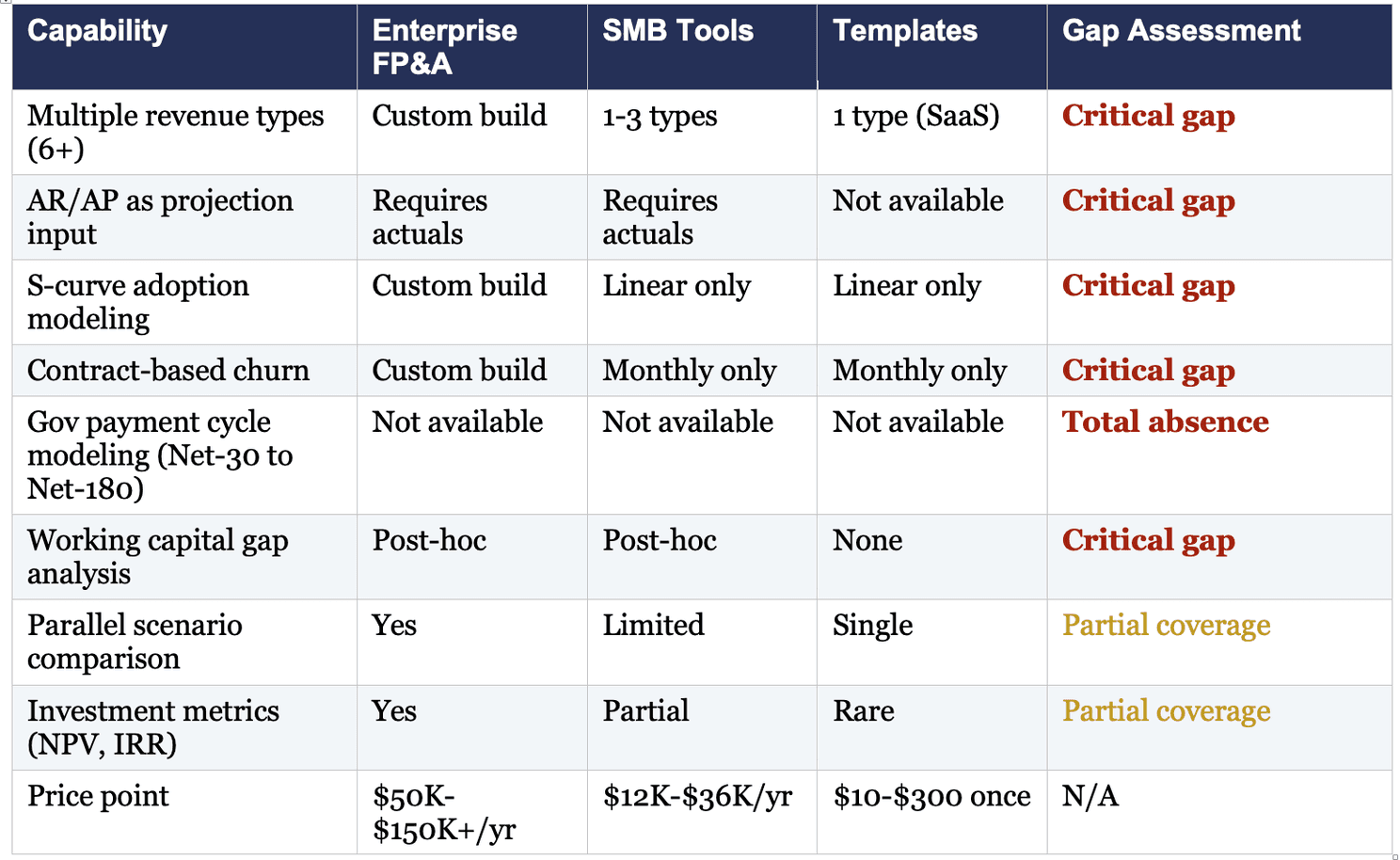

5.5 Comparative Analysis: Financial Planning Tools for B2G

Table 2. Financial Planning Tool Capabilities vs. B2G Requirements. Analysis based on review of 50+ templates and feature documentation of major platforms.

The pattern is clear. At every price point and sophistication level, the financial planning tools available to founders assume a subscription-based revenue model with monthly payment cycles and linear growth. The specific capabilities required for B2G financial planning, including contract-based revenue modeling, government payment cycle projection, S-curve adoption, and proactive working capital gap analysis, are absent from the market. The gap is not in one segment or one price tier. It is universal.

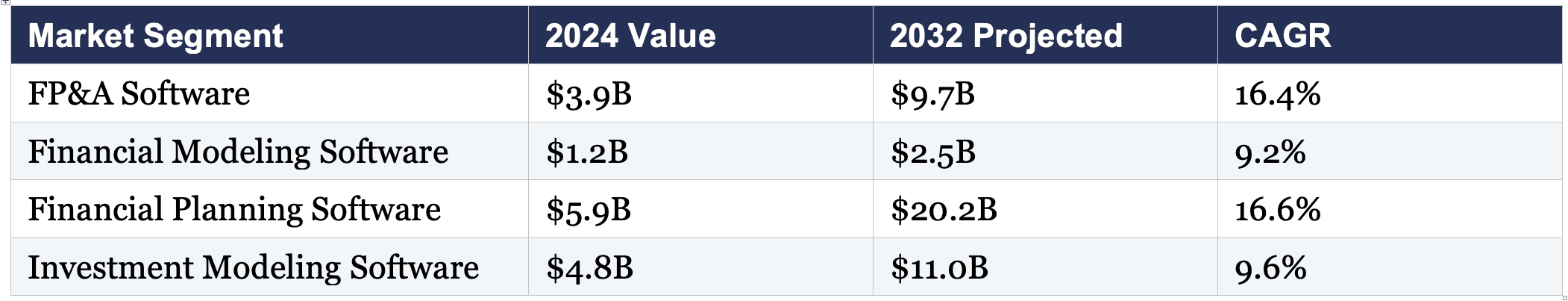

5.6 The FP&A Market Opportunity

The broader financial planning and analysis software market provides context for the scale of this opportunity:

Table 3. Financial Planning and Analysis Software Market Projections. Source: Industry Research Reports 2024.

Within a combined FP&A and financial planning market approaching $44 billion by 2032, the B2G-specific segment remains entirely unserved. This is not a niche gap; given the $183.5 billion in federal small business contracts alone, it represents a meaningful and growing market need.

6. The Regulatory Dimension: Institutional Demand for Standardization

The absence of appropriate financial planning tools for B2G is not just a market inefficiency. It has regulatory implications. Governments around the world are increasingly required to assess the financial viability of their technology vendors, particularly startups, and they lack the standardized tools to do so.

6.1 United States: GAO Requirements

The US Government Accountability Office provides clear guidance that financial capability assessment is a mandatory component of determining contractor responsibility. Federal agencies must verify that prospective contractors possess adequate financial resources, or the ability to obtain them, to fulfill contractual obligations. For traditional defense contractors with decades of audited financial statements, this assessment is straightforward. For a two-year-old GovTech startup with negative operating margins and no revenue history, the assessment requires exactly the kind of forward-looking, scenario-based cash flow modeling that does not exist in standardized form.

The practical consequence is that government agencies either (a) avoid contracting with startups entirely, defaulting to established vendors and perpetuating the innovation gap, or (b) accept the startup's VC-formatted financial projections at face value, without recognizing that those projections are built on assumptions (monthly revenue, linear growth) that are structurally incompatible with how the government contract will actually perform.

6.2 United Kingdom: The Sourcing Playbook

The UK Cabinet Office Sourcing Playbook mandates a formal Economic and Financial Standing (EFS) assessment for suppliers of public contracts. A dedicated Financial Viability Risk Assessment Tool (FVRA) has been developed for this purpose. However, as multiple analyses have noted, these instruments are calibrated for mature companies with established profitability records. Startups, by definition, do not have such records, and the FVRA framework does not account for the scenario-based financial projections that would be necessary to evaluate early-stage companies operating in government markets.

This creates a paradox: the UK government actively encourages innovation through programs like GovStart and the GovTech Catalyst, but its own financial assessment framework creates barriers for the very companies it seeks to attract.

6.3 OECD Guidelines and Global Implications

At the international level, the OECD has issued recommendations on public procurement of innovation that explicitly call for the use of appropriate IT-based tools for vendor risk assessment. The OECD has documented innovation procurement practices across 83 countries and found that while 42 percent of OECD governments now engage in innovation-focused procurement, the standardized financial assessment infrastructure for evaluating innovative (and therefore inherently riskier) suppliers remains underdeveloped.

The implication is clear: there is not only a market opportunity for B2G-specific financial planning tools, but an emerging regulatory requirement. As governments worldwide formalize their innovation procurement programs, the demand for standardized, purpose-built financial assessment frameworks will grow from a nice-to-have to a compliance necessity.

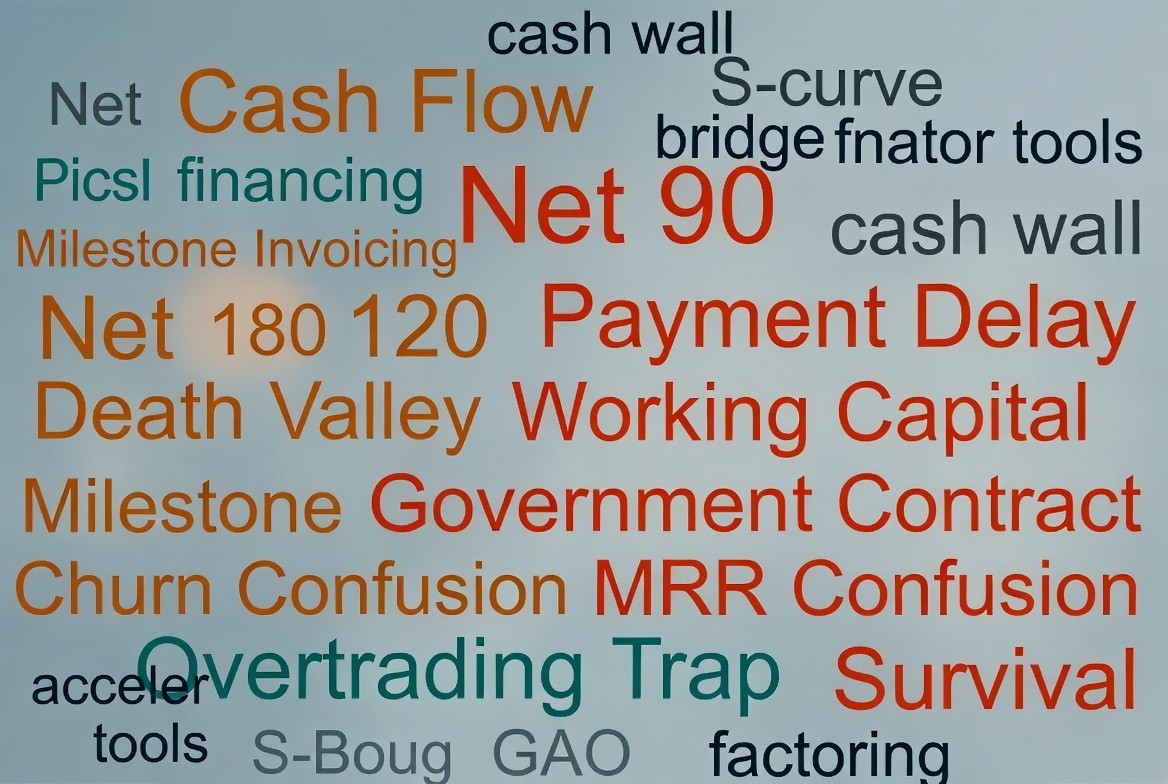

7. The Voice of the Market: What Practitioners Are Saying

The problems described in this report are not abstractions. They are lived daily by founders, investors, and program managers throughout the B2G ecosystem. An analysis of public discussions on Reddit, Hacker News, and professional forums reveals consistent themes.

7.1 On Payment Delays

Discussions about government and enterprise payment terms are among the most emotionally charged conversations in startup communities. Founders describe situations where securing a major contract, ostensibly the moment of greatest achievement, actually precipitates a cash crisis.

"Net 90 eventually becomes net 120 - 6 months waiting for a check." - Hacker News contributor, on the reality of enterprise payment terms

In the r/smallbusiness subreddit, a thread about a large defense company's nonpayment described a contractor waiting months beyond already-extended payment terms. The discussion revealed that this is not exceptional but routine, particularly in sectors adjacent to government. Multiple contributors noted that large organizations use extended payment terms as a form of free financing from their suppliers, with smaller vendors bearing the cost of working capital that the buyer chooses not to deploy.

QuickBooks research cited by the U.S. Chamber of Commerce found that 60 percent of small businesses offering 90-day payment terms experienced cash flow problems, compared to 40 percent of those requiring payment upon receipt. For B2G startups, 90-day terms are not an option they choose but a condition imposed by their customer.

7.2 On Metric Confusion

The confusion around applying SaaS metrics to non-subscription businesses is widespread and well-documented in practitioner discussions. On Hacker News, contributors have noted that using revenue metrics designed for companies with 80 percent or higher gross margins on businesses with significantly different economics creates misleading impressions that can deceive investors.

In the r/SaaS subreddit, discussions about the distinction between MRR and ARR frequently reveal founders struggling to represent their contract-based revenue in terms that investors will recognize. The fundamental tension, between presenting reality and presenting what investors expect to see, is palpable in these conversations.

7.3 On the Tools Gap

Perhaps most tellingly, there is no active community of practitioners sharing B2G-specific financial modeling best practices. While the SaaS metrics community has produced an extensive body of knowledge (David Skok's for Entrepreneurs blog, Jason Lemkin's SaaStr, Ben Murray's SaaS CFO), no equivalent body of knowledge exists for B2G financial planning. The absence of this community is itself evidence of the infrastructure gap: practitioners cannot share best practices for tools that do not exist.

Figure 3: Thematic Analysis of Practitioner Discussions. Source: Analysis of public discussions on Reddit and Hacker News communities, 2023-2025.

8. Toward a Solution: What B2G Financial Infrastructure Should Look Like

Having documented the problem across its operational, investment, and regulatory dimensions, it is appropriate to consider what an adequate solution would require. The following characteristics are not aspirational; they are minimum requirements derived from the structural realities of B2G business operations.

8.1 Contract-Based Revenue Architecture

Any financial planning tool suitable for B2G must treat the contract, not the monthly subscription, as the fundamental unit of revenue. This means supporting multiple revenue types within a single model: recurring SaaS subscriptions, milestone-based project payments, one-time implementation fees, usage-based charges, maintenance and support contracts, and hybrid structures that combine several of these elements. Government contracts routinely include two, three, or even four of these revenue types within a single agreement.

8.2 Payment Delay as a Core Planning Input

In B2G financial planning, the gap between revenue recognition and cash receipt is not an afterthought; it is the central planning challenge. An adequate tool must allow founders to specify different payment terms for different customer segments (e.g., government at Net-90, commercial at Net-30) and to model the cash flow implications dynamically across the entire projection period. This is fundamentally different from the accounts receivable tracking offered by existing FP&A tools, which calculate payment delays based on historical actuals rather than forward-looking assumptions.

8.3 S-Curve Adoption Modeling

Growth projections for B2G companies must follow validated adoption curves rather than linear or simple exponential assumptions. The mathematical framework exists: sigmoid functions and smoothstep functions can model the three-phase adoption pattern (slow ramp-up, acceleration, saturation) with high fidelity. What is needed is the embedding of these functions in accessible financial planning tools so that founders can produce projections that reflect the reality of government technology adoption.

8.4 Working Capital Gap Analysis

The most critical output of a B2G financial model is not the profit and loss statement but the working capital gap analysis. This analysis must integrate all three financial statements (income statement, balance sheet, and cash flow statement) to reveal when, by how much, and for how long the company will face cash shortfalls. This information enables founders to plan bridge financing, negotiate factoring arrangements, or time fundraising rounds to coincide with predictable cash gaps rather than reacting to emergencies.

8.5 Scenario Comparison

Given the inherent uncertainty in government procurement (RFP timelines can shift by quarters, budgets can be frozen, political priorities can change), single-point financial projections are inadequate. B2G financial models must support at minimum three parallel scenarios (conservative, base case, and optimistic) with consistent structural assumptions, allowing stakeholders to understand the range of potential outcomes rather than anchoring on a single forecast.

These requirements are not exotic. They represent the application of established financial modeling principles, specifically contract-based revenue recognition, working capital management, and scenario analysis, to a market segment that has been systematically overlooked by the financial technology industry. The question is not whether such tools can be built, but why they have not been built already, and what it will take for the ecosystem to recognize and address this gap.

This exact set of capabilities is what we have developed at Verter Studio — the first financial planning platform designed specifically for the realities of B2G and contract-based revenue models.

9. A Call for Honest Conversation

This report has documented a systemic infrastructure gap that affects every participant in the B2G ecosystem. The evidence is drawn from regulatory requirements, market data, practitioner discussions, and a comprehensive analysis of available tools. The conclusion is straightforward: the B2G sector is growing rapidly, but the financial planning infrastructure that should support it has not kept pace.

The implications extend beyond individual startups. When B2G companies fail because of preventable cash flow crises, the consequences ripple outward. Government innovation programs lose credibility, making it harder to justify future investments in startup partnerships. Investors who lose capital on B2G investments become reluctant to fund the sector, reducing the flow of capital precisely when it is most needed. Founders who could have succeeded with better planning tools turn away from government markets entirely, depriving the public sector of the innovation it desperately needs.

The ecosystem needs an honest conversation about this gap, and that conversation must involve all stakeholders:

Venture capital firms must develop evaluation frameworks that account for contract-based revenue dynamics, S-curve growth patterns, and the working capital implications of government payment cycles. The GovTech-focused funds, including Govtech Fund, Andreessen Horowitz's government technology investments, and emerging sector-specific vehicles, are best positioned to lead this evolution. But the change must extend beyond specialist funds to the broader VC community, which increasingly encounters B2G companies in its deal flow.

Accelerator programs must integrate B2G-specific financial planning into their curricula. Programs like CivStart, Leading Cities, and MDIA have direct access to the founders who need this support most. The question for these organizations is whether they are equipping their startups with financial tools that match the operating reality those startups will face, or whether they are inadvertently sending companies into government procurement with financial models that will fail them at the moment of greatest need.

Government innovation offices must acknowledge that their financial assessment frameworks are poorly suited to evaluating early-stage companies, and must work to develop or adopt standardized tools that can assess the financial viability of innovative suppliers without penalizing them for not looking like traditional defense contractors.

The financial technology community must recognize that B2G represents a significant, underserved market within the broader FP&A landscape. With the FP&A software market alone projected to grow from $3.9 billion to $9.7 billion by 2032, and with over 94,000 potential B2G users currently lacking appropriate tools, the commercial opportunity is substantial. Some early-stage initiatives have begun to emerge in this space, developing purpose-built methodologies for contract-based financial planning, but the market remains overwhelmingly unserved.

Founders themselves must resist the temptation to simply translate their business into SaaS terminology to satisfy investor expectations. Presenting a government contract business as if it were a subscription business may help close a funding round, but it creates misaligned expectations that will manifest as conflict and disappointment later. The B2G sector needs founders who are willing to educate their investors about the realities of government markets, even when that means accepting a more complex conversation than the standard SaaS pitch.

10. Conclusion: Infrastructure Before Innovation

The $2.9 trillion GovTech market represents one of the most significant growth opportunities in the global technology economy. Government demand for startup innovation has never been higher. Funding is available. Institutional support structures are expanding. The market conditions are, by virtually every measure, favorable.

What is missing is the financial infrastructure that enables the participants in this market to make good decisions. Startups need tools that model their actual business dynamics, not sanitized SaaS approximations. Investors need evaluation frameworks that reveal the true risk and return characteristics of B2G companies, not metrics borrowed from consumer subscription businesses. Government agencies need standardized assessment instruments that can distinguish between a financially viable innovative supplier and a cash-flow crisis waiting to happen.

Until this infrastructure exists, the B2G ecosystem will continue to operate with a dangerous gap between its ambition and its capacity. Capital will be misallocated. Promising companies will fail preventable deaths. Government innovation programs will underperform their potential. And the gap between the government's need for innovation and the ecosystem's ability to deliver it will persist.

The technology to close this gap is not complex. The financial modeling principles involved, including contract-based revenue recognition, working capital management, scenario analysis, and S-curve adoption modeling, are well understood. What has been lacking is the recognition that these principles need to be assembled into accessible, purpose-built tools for a specific and growing market segment.

The question for the ecosystem is not whether this infrastructure will be built. The market demand, the regulatory pressure, and the scale of the opportunity make it inevitable. The question is how quickly it will happen, and how many more B2G startups will fail in the meantime, not because their products were inadequate or their markets were insufficient, but because the financial tools available to them were designed for a different world.

Because in B2G, cash-flow failure is not a founder mistake. It is a capital allocation failure, an ecosystem failure, and one that every stakeholder has both the responsibility and the capability to help correct.

Anatolii Vovniuk, Founder & CEO, Verter Studio — building the first purpose-built financial planning platform for B2G and contract-based businesses.

av@verter.studio | verter.studio

References

1. Tracxn GovTech Sector Report (October 2025). https://tracxn.com/d/sectors/govtech/

2. CB Insights, "Top Reasons Startups Fail" (2023). Data on startup failure causes.

3. Brex, "8 Cash Flow Problems Startups Deal With & How to Solve Them" (2025). https://www.brex.com/spend-trends/cash-flow-management/cash-flow-problems

4. Techstars, "The 8 Most Common Startup Cash Flow Problems and How to Solve Them." https://www.techstars.com/blog/advice/8-most-common-startup-cash-flow-problems-and-how-to-solve-them

5. Reddit, r/smallbusiness, "My primary client is switching to Net 90 payment terms." https://www.reddit.com/r/smallbusiness/comments/ds2ghq/

6. Reddit, r/explainlikeimfive, "ELI5: Why do companies have Net 30/60/90 terms?" https://www.reddit.com/r/explainlikeimfive/comments/tb2ru0/

7. Reddit, r/SideProject, "Landed a huge deal but they won't pay for 3 months." https://www.reddit.com/r/SideProject/comments/1qenflf/

8. Reddit, r/smallbusiness, "Large defense company non-payment status." https://www.reddit.com/r/smallbusiness/comments/1pchi1q/

9. Capital Source Group, "Government Contract Cash Flow Problems: Why 70% of Contractors Face Delayed Payments" (2025). https://capitalsourcegroup.com/2025/06/09/government-contract-cash-flow-problems/

10. Hacker News, "Understanding SaaS Metrics" discussion thread. https://news.ycombinator.com/item?id=26931086

11. Hacker News, "MRR and ARR are gross, not net revenue" discussion. https://news.ycombinator.com/item?id=36032611

12. Hacker News, "Is it just me that feels stuck in annual SaaS Contracts?" https://news.ycombinator.com/item?id=26217536

13. Rogers, E.M. Diffusion of Innovations Theory. Referenced via RMI, "A Theory of Rapid Transition." https://rmi.org/wp-content/uploads/2022/10/theory_of_rapid_transition_how_s_curves_work.pdf

14. Medium/Grove Ventures, "Technology's Favorite Curve: The S-Curve." https://medium.com/groveventures/technologys-favorite-curve-the-s-curve-and-why-it-matters-to-you-249367792bd7

15. U.S. GAO, NSIAD-90-200BR, "Government Contracting: Financial Measures for Evaluating Contractor Profitability." https://www.gao.gov/assets/nsiad-90-200br.pdf

16. U.S. Acquisition.gov, DFARS 253.209-1, "Responsible Prospective Contractors." https://www.acquisition.gov/dfars/253.209-1

17. UK Cabinet Office, The Sourcing Playbook (June 2023). https://www.gov.uk/government/publications/the-sourcing-and-consultancy-playbooks

18. UK Cabinet Office, "Financial Viability Risk Assessment Tool," version 6.1.

19. OECD, "Implementing the OECD Recommendation on Public Procurement." https://www.oecd.org/en/publications/implementing-the-oecd-recommendation-on-public-procurement-in-oecd-and-partner-countries_02a46a58-en/

20. OECD/World Bank, "OECD Work on Public Procurement." https://thedocs.worldbank.org/en/doc/367261525344954013-0080022018/render/PRIMO14ENPauloMaginaOECD.pdf

21. StartUs Insights, "GovTech Outlook 2025" (July 2025). https://www.startus-insights.com/innovators-guide/govtech-outlook/

22. Crunchbase, "No One Gushes About Govtech, But It Can Produce Some Nice Returns" (March 2024). https://news.crunchbase.com/policy-regulation/government-tech-startups-funding-opengov-acquisition-valuation/

23. Reddit, r/SaaS, "MRR vs ARR: A dumb question I have to ask." https://www.reddit.com/r/SaaS/comments/10b770c/

24. Reddit, r/smallbusiness, "Why did you shut down your small business?" https://www.reddit.com/r/smallbusiness/comments/17h7ytm/

25. J.P. Morgan, "How net payment terms affect working capital." https://www.jpmorgan.com/insights/banking/commercial-banking/net-payment-terms-benefits-of-net-30-60-90-terms

26. Order.co, "How Net Terms as a Service Help Vendors and Buyers Thrive." https://www.order.co/blog/finance/net-terms-as-a-service/

27. Payro Finance, "Government Contract Factoring: Mitigating Payment Delays." https://payrofinance.com/government-contract-factoring-mitigating-payment-delays-and-ensuring-stability/

28. U.S. Chamber of Commerce, "Top 4 Cash Flow Problems in Small Businesses" (October 2025). https://www.uschamber.com/co/run/finance/small-business-cash-flow-disruptions

29. Capflow Funding, "Cash Flow Issues in 2025: Challenges, Causes & Solutions." https://capflowfunding.com/cash-flow-issues-in-2025-challenges-causes-solutions/

30. SBA, Small Business Federal Contracting Scorecard, FY 2024 data.

31. Ntegra, "Technology Adoption with the S-Curve Model." https://www.ntegra.com/insights/navigating-the-adoption-process-of-technologyinnovation

32. NREL, "Bridging the Valley of Death: Transitioning from Public to Private Sector Financing." https://docs.nrel.gov/docs/gen/fy03/34036.pdf

33. ain ventures, "The US Government's Innovation Valley of Death." https://www.ainventures.com/post/the-valley-of-death

34. PYMNTS.com, "B2B Payments Enter Their Trust-Building Era" (August 2025). https://www.pymnts.com/news/b2b-payments/2025/b2b-payments-enter-their-trust-building-era

35. SCORE, "Decoding SaaS Revenue Metrics." https://www.score.org/resource/article/decoding-saas-revenue-metrics

36. Rho, "Govtech Funding: 6 VCs for Your Startup" (September 2025). https://www.rho.co/blog/vcs-in-govtech

37. USAspending.gov, Federal Contract Spending by Industry.

38. CivStart.org, GovTech accelerator program information.

39. Leading Cities / AcceliCITY accelerator program data.

40. MDIA (Miami-Dade Innovation Authority), program evaluation data.

View more articles

Learn actionable strategies, proven workflows, and tips from experts to help your product thrive.